Crypto triangular arbitrage of high frequency within Binance is an automated trading strategy that takes advantage of price differences between three cryptocurrency pairs in the same exchange.

This strategy is based on the idea that cryptocurrencies within the same exchange often have slightly different prices due to supply and demand on each trading pair. Therefore, traders can take advantage of these small price discrepancies to make profits.

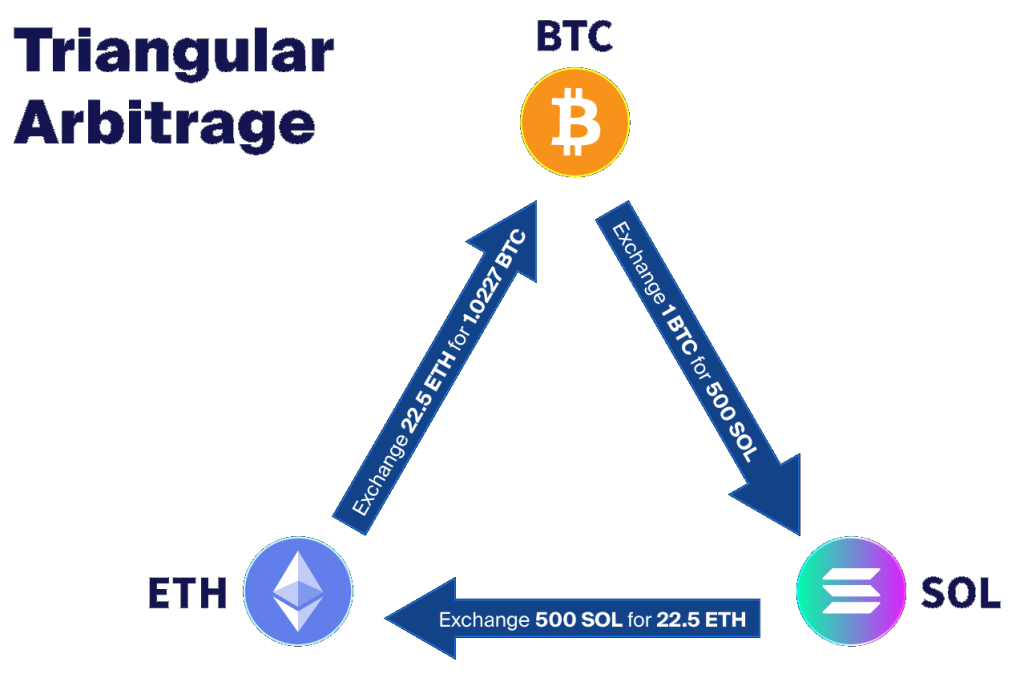

For example, if the price of Bitcoin (BTC) is lower on the BTC/USDT pair than on the BTC/ETH pair and the price of ETH is lower on the ETH/USDT pair than on the BTC/ETH pair, a trader can buy BTC with USDT, then buy ETH with BTC, and finally sell ETH for USDT. If the profit obtained in this operation exceeds transaction costs and any other associated costs, the trader will make a net profit.

To carry out this strategy, traders use automated trading algorithms that constantly monitor the prices of different trading pairs and execute buy and sell orders in milliseconds to take advantage of any arbitrage opportunities that arise.

This type of trading requires a high degree of knowledge of cryptocurrency markets and automated trading algorithms. Additionally, there are inherent risks associated with cryptocurrency trading, such as market volatility and the possibility of software errors. Therefore, it is important to be careful when investing in cryptocurrencies and always seek professional financial advice before making investment decisions.